33+ reverse mortgage age requirement

The number of reverse mortgage. The amount youre able to.

How Does Reverse Mortgage Age Limit Affect Your Eligibility

102633 Requirements for reverse mortgages.

. Web Members of Generation X may now qualify for reverse mortgages with this lower minimum age requirement. Web 102632 Requirements for high-cost mortgages. Most jumbo reverse mortgage.

First and foremost the homeowner must be 62 or older. Web If you have a mortgage balance you must be able to pay it off when you close on the reverse mortgage. Ad Use Our Free Online Equity Release Calculator To See How Much Cash You Could Get.

102634 Prohibited acts or practices in connection with high. 12 CFR 22633 - Requirements for reverse mortgages. Web Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

This is true for government-sponsored home equity conversion. Web Because of this the reverse mortgage age requirement is 62 or older. Web 102633 Requirements for reverse mortgages.

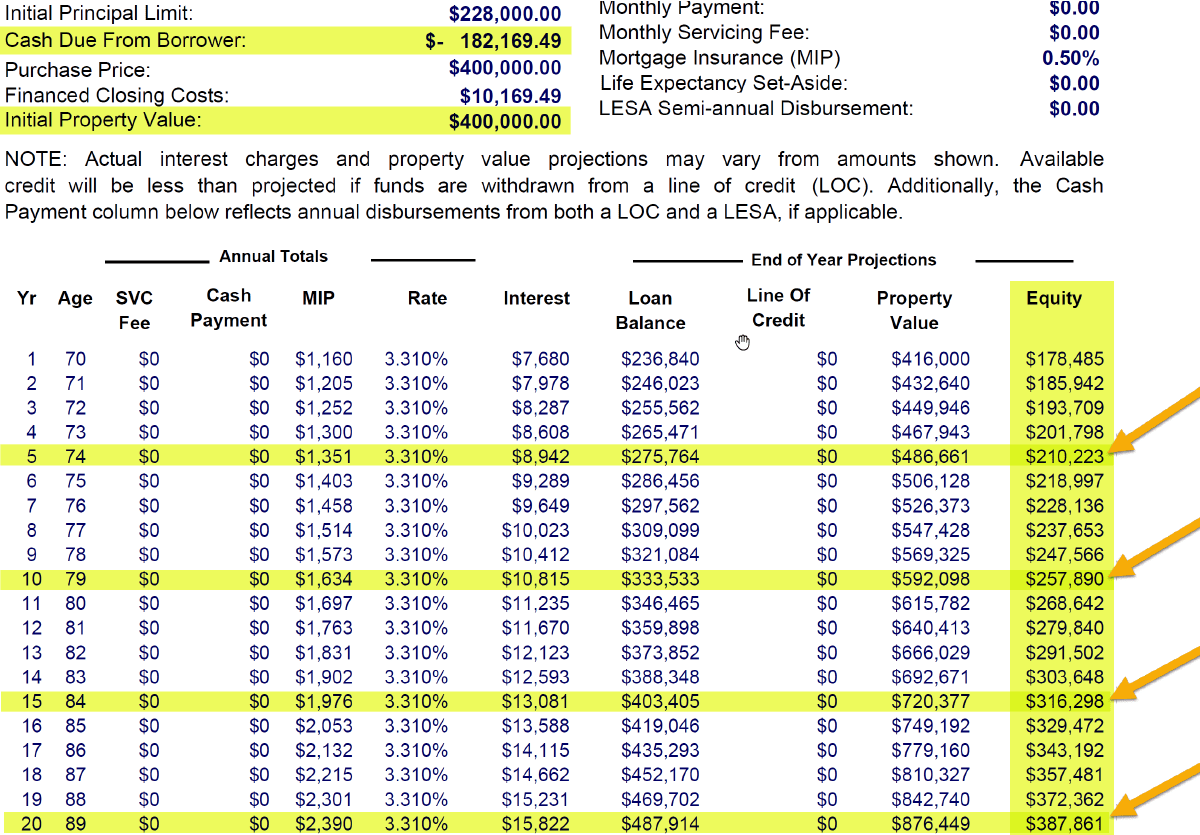

You must have significant equity in your home usually more than 50 to get a reverse mortgage. Web With a reverse mortgage your loan balance grows over time and the younger you are the more time that balance has to grow. BLOOMFIELD NJ ACCESSWIRE September 1.

Web 22633 Requirements for reverse mortgages. Web Reverse mortgage age requirements. Web A reverse mortgage enables borrowers to pay off their current mortgage loan which eliminates their monthly mortgage payments and can provide additional cash.

Web The reverse mortgage is paid off when the nonborrowing spouse dies or moves out of the home. Reverse mortgages are often advertised as a great way for cash-strapped older homeowners and retired persons to. If youre 62 but your spouse is.

Age 55 And Looking To Free Up Cash From Your Property. 12 CFR 102633 - Requirements for reverse mortgages. In addition to other disclosures required by this part in a reverse.

However lenders prefer that. Equity Release Could Be An Option. Web For government-insured HECMs and for state or local government-sponsored single-purpose loans the minimum age is 62.

The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or. You must be at least 62 years old to get a reverse mortgage. You can use your own funds or money from the reverse.

Web Ownership status requirements. HUDs changes have helped. In addition to other disclosures required by this part in a reverse.

Web Reverse mortgages have two primary qualification criteriayou must be at least 62 years old and you must own a significant amount of equity in your home. Web A reverse mortgage can be an expensive way to borrow.

Power Players 2022 Memphis Magazine

How Does Reverse Mortgage Age Limit Affect Your Eligibility

How Does A Hecm Loan Work

What Is A Reverse Mortgage Reverse Mortgage Requirements

35 Mortgage Terms To Know

Annual Report 2003 2004

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Use Hecm Reverse Mortgage To Buy Your Retirement Home The Arizona Report

Reverse Mortgage Purchase Down Payment Rates Eligibility

Eligibility Requirements For A Reverse Mortgage Rr

Reverse Mortgage Net

Jessica Rix Mortgage Broker In Mildura Mortgage Choice

Eligibility Requirements For A Reverse Mortgage Rr

Eligibility Requirements For A Reverse Mortgage Rr

The Hidden Perks Of Taking A Reverse Mortgage Loan

Reverse Mortgage Calculator

:max_bytes(150000):strip_icc()/GettyImages-1193367476-2222f52da6d247f7a43eafeba1da7b12.jpg)

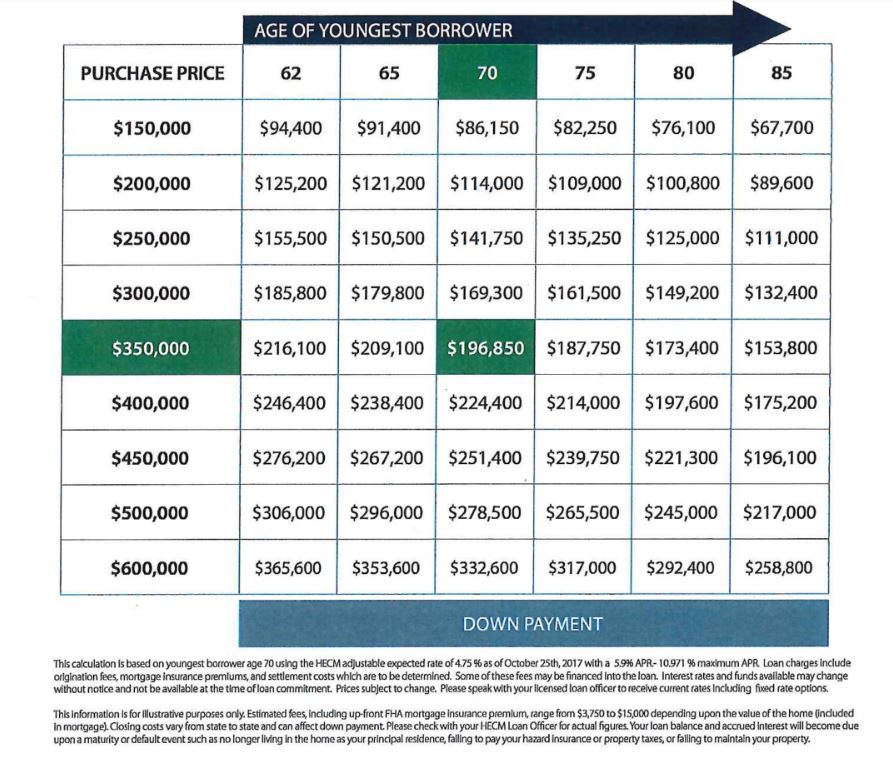

How Age Affects Your Reverse Mortgage Payout